Case Study: Tradespect's Accuracy in Identifying Market Tops and Bottoms Written on . Posted in Tradespect Case Studies.

Introduction: The financial markets are fraught with noise, making it challenging for retail traders to make informed decisions. Tradespect, a renowned platform, has designed a set of tools aiming to provide traders an edge by identifying market tops and bottoms with high precision.

Key Tools by Tradespect:

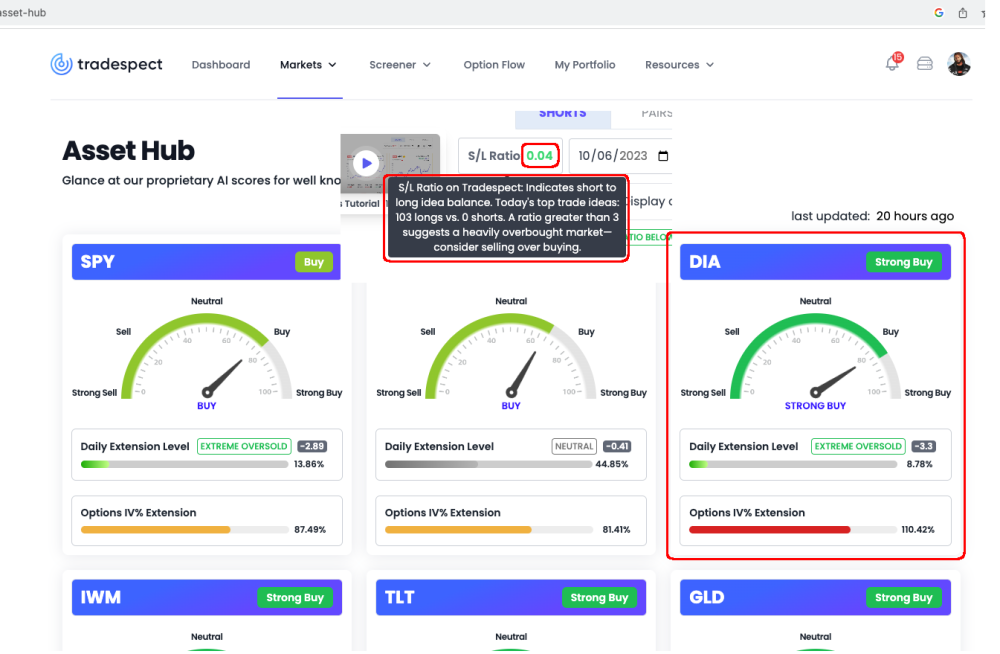

Asset Hub: This tool is designed to issue smart money buy/sell signals. These are primarily contrarian signals, meaning they go against the current market trend. The objective is to spot overbought or oversold market conditions, which are precursors to potential tops and bottoms respectively.

S/L Ratio: This ratio is an essential metric that helps identify oversold conditions. An S/L ratio below 0.03 is a rarity and when witnessed, it signals a heavy bias towards long positions within the Russell 1000, indicating the market may be at its bottom.

Case Examination: SPY, QQQ, and DIA

Asset Hub's Signals:

For SPY, QQQ, and the DIA, the Asset Hub flashed both 'Strong Buy' and 'Buy' signals. This clearly indicated that these markets were in a heavily oversold condition. In financial parlance, when markets are oversold, they often represent a buying opportunity, signaling potential bottoms.

S/L Ratio's Indication:

The S/L ratio showcased a value below 0.03. To provide context, there were 103 long positions for every short position, which is a significant skew. This extreme disparity in the ratio further confirmed that the market was oversold, making it ripe for a bounce.

Real-life Example: QQQ

Upon examining the QQQ's historical data, it was found that whenever the Asset Hub signaled 'Strong Buy' or 'Buy' and the S/L ratio dipped below 0.03 (like the 103:0 Long to Short scenario), the QQQ typically experienced a bounce. This bounce indicated that the market had indeed bottomed out and was now on a rebound.

Conclusion:

By combining the intelligence from both the Asset Hub and the S/L ratio, Tradespect offers retail traders a potent duo to navigate the markets. These tools help to filter out market noise, allowing traders to focus on fundamental market dynamics and smart money moves. The case of QQQ acts as a testament to Tradespect's prowess in catching market bottoms accurately. With these tools at their disposal, retail traders can potentially increase their chances of making more informed and profitable decisions.