ai-backed stock market toolkit for contrarian U.S traders

Accelerate your trading journey with AI-Powered trade ideas

Get the highest probability AI trade ideas—hundreds a month. Algorithmic price reversal detection across 8,000+ U.S stocks. No more gambling: be a profitable trader that uses state of the art AI.

Everything you need to win more trades.

Unlock a comprehensive toolkit for trade success. Sit back and let the markets work their magic while you focus on winning trades.

Trade ideas with a high success rate exceeding the competition, backed by backtesting. Proprietary contrarian logic identifies stock tops and bottoms with remarkable precision.

Completely Eliminate the 'Gambling' Element from Trading

Tradespect relies on proven statistical analysis and probability to generate high-confidence trade ideas for the US markets. We prioritize math over luck.

AI Trade Ideas

High-confidence trade ideas available daily; never run out of opportunities.

Constantly adapting high-probability AI-generated ideas with real-time features, all designed with the retail trader in mind. No complexities, just excellent trade ideas.

Risk Management

AI-generated Take Profit levels ensure you close trades at optimal prices.

Employ the recommended take-profit and stop-loss levels to effectively manage risk. By incorporating stops, you can secure all your winning trades and retain them until reaching the take-profit point.

Forward-tested

Years of forward-tested data demonstrate the success rate of our trade ideas.

Over a year of trade data, taking all of them would result in a net positive return. Our AI win rates are continuously improved and adapted to reflect changing market conditions.

Detailed Order Flow

Gain insights into all key stock data to make informed and holistic decisions.

Click on an idea to access all its key data, including insider trades, options order flows, large dark pool orders, charts, and more—all in one place, eliminating the need for multiple platform subscriptions.

Reversal Detection Tools

Market reversal tools keep you on the right side of the market at all times.

Tools designed with contrarian reversal logic in mind, encompassing smart-money buy/sell meters, options zones, crypto meters, and industry monitoring. Together, these tools can precisely pinpoint market tops and bottoms.

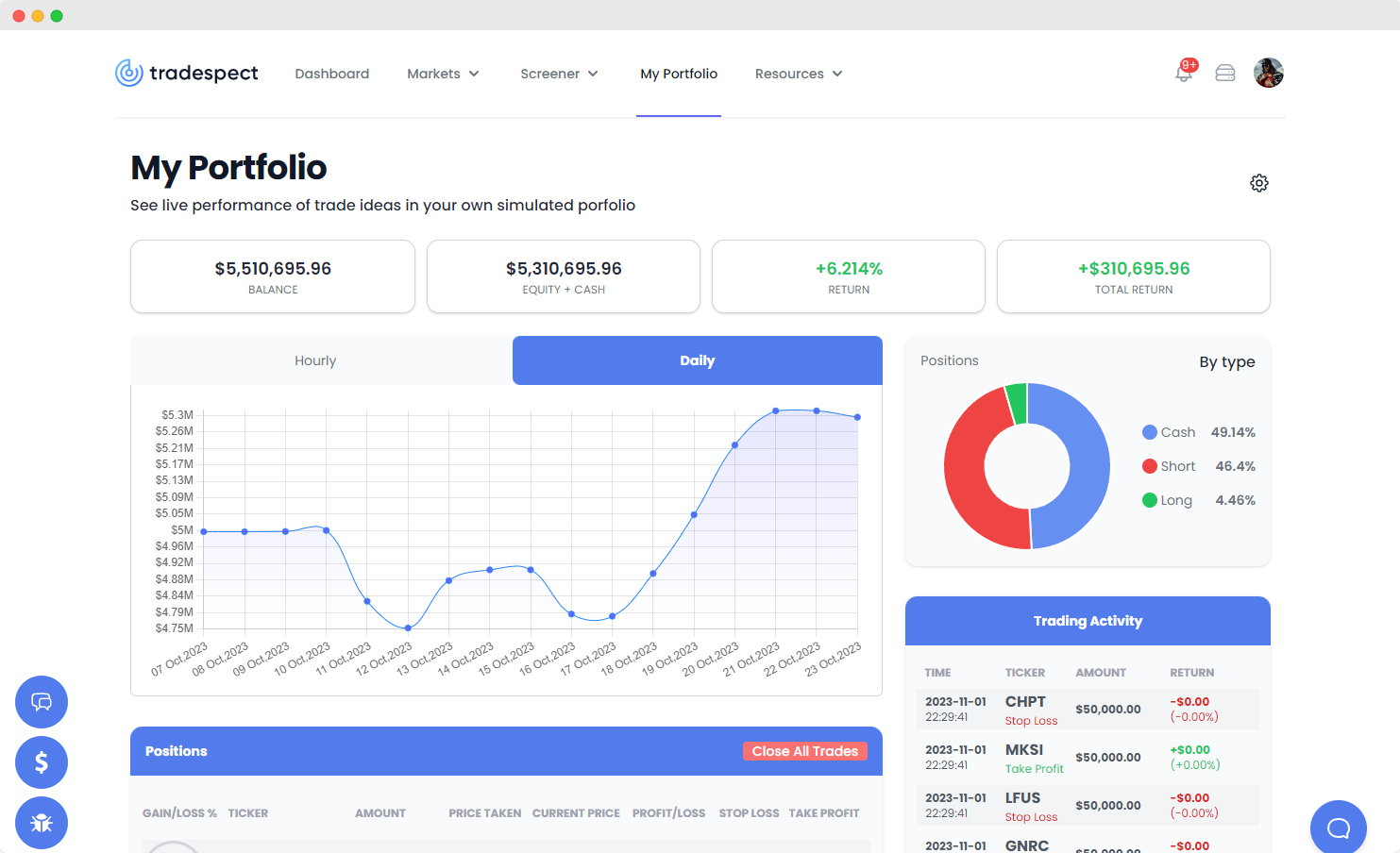

Integrated Paper Trading

Simulate trade ideas firsthand with paper money in real markets.

Boost your confidence by testing our ideas in your personal portfolio. Once you feel comfortable and profitable in a simulated environment, apply your knowledge to take trades in the real markets!

OUR FEATURES

Embody the Smart-Money.

Tools that put you far ahead of the average retail trader. Don't just follow smart-money trades; emulate them.

Create your account today

Experience key Tradespect features with a free limited account. If you find it valuable, consider upgrading!

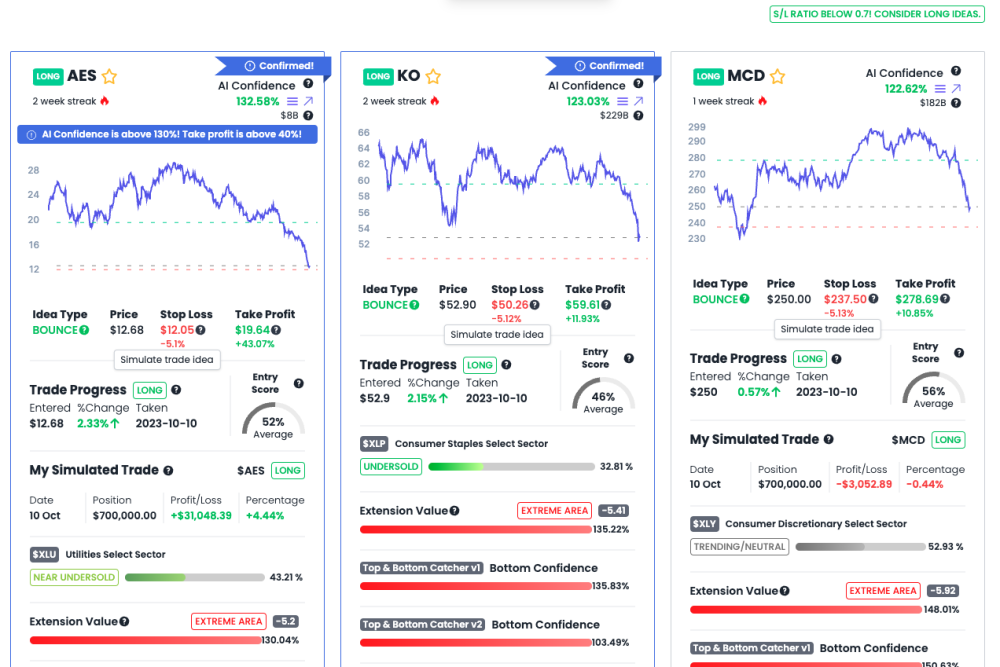

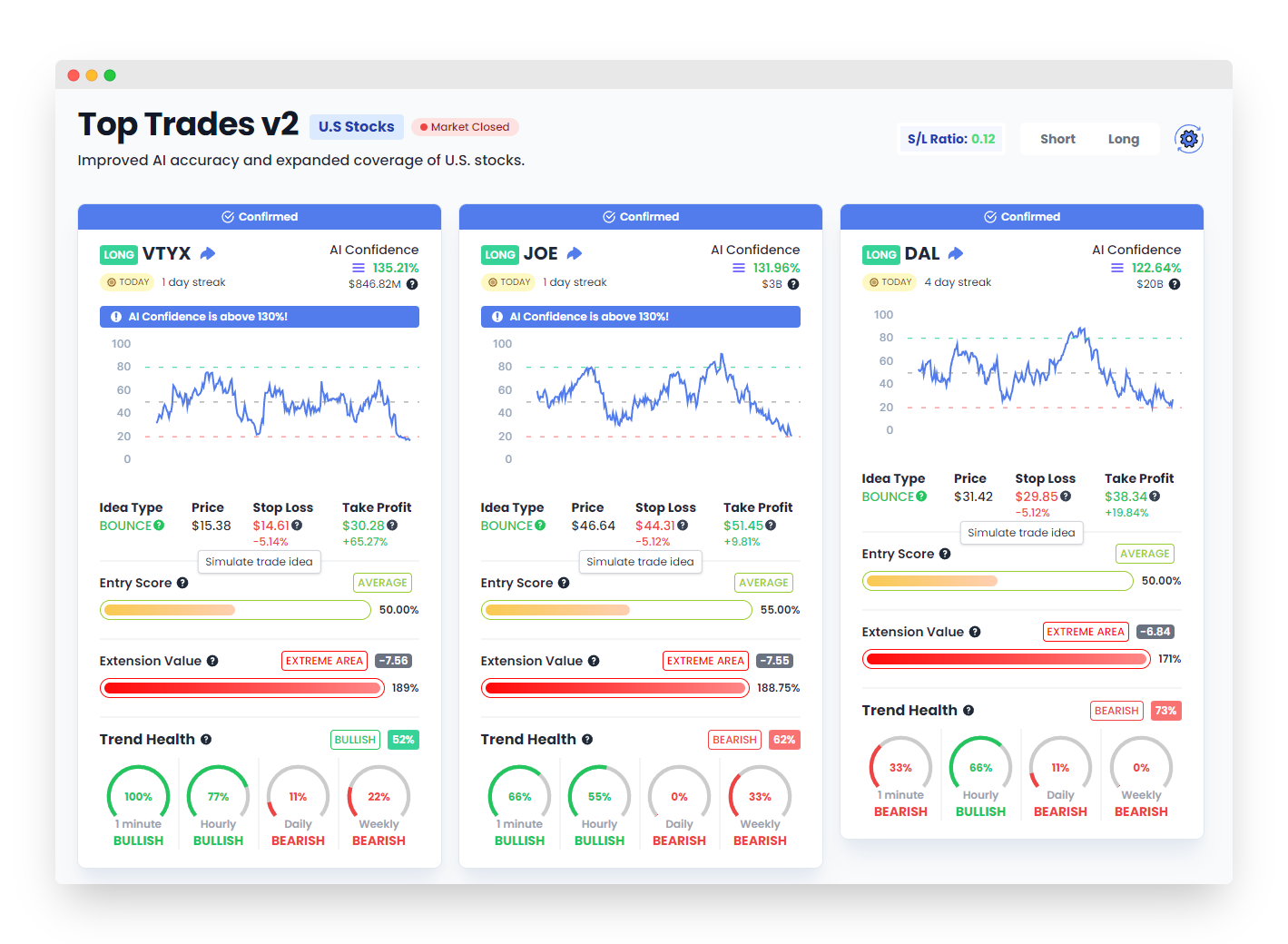

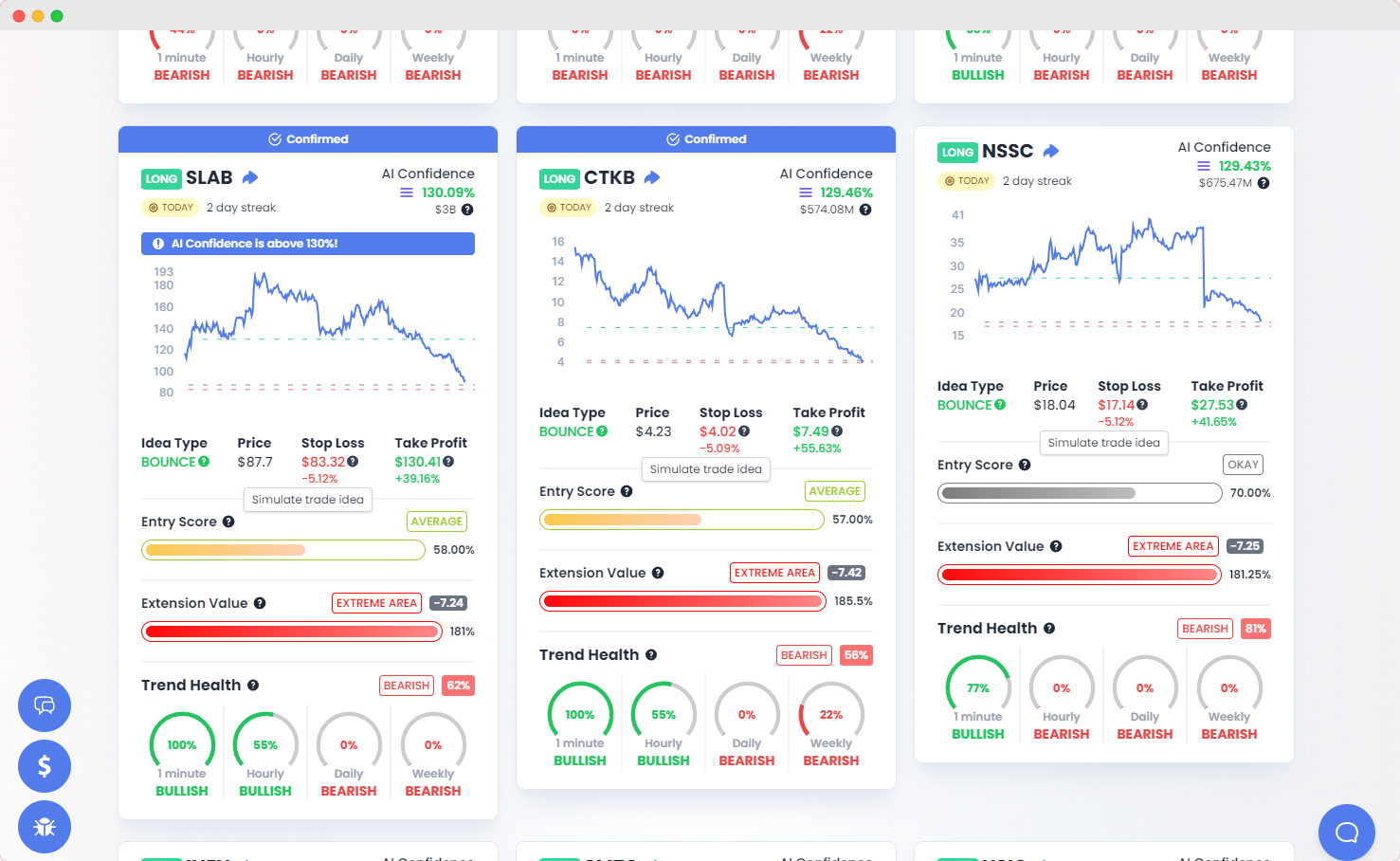

Top Trades:

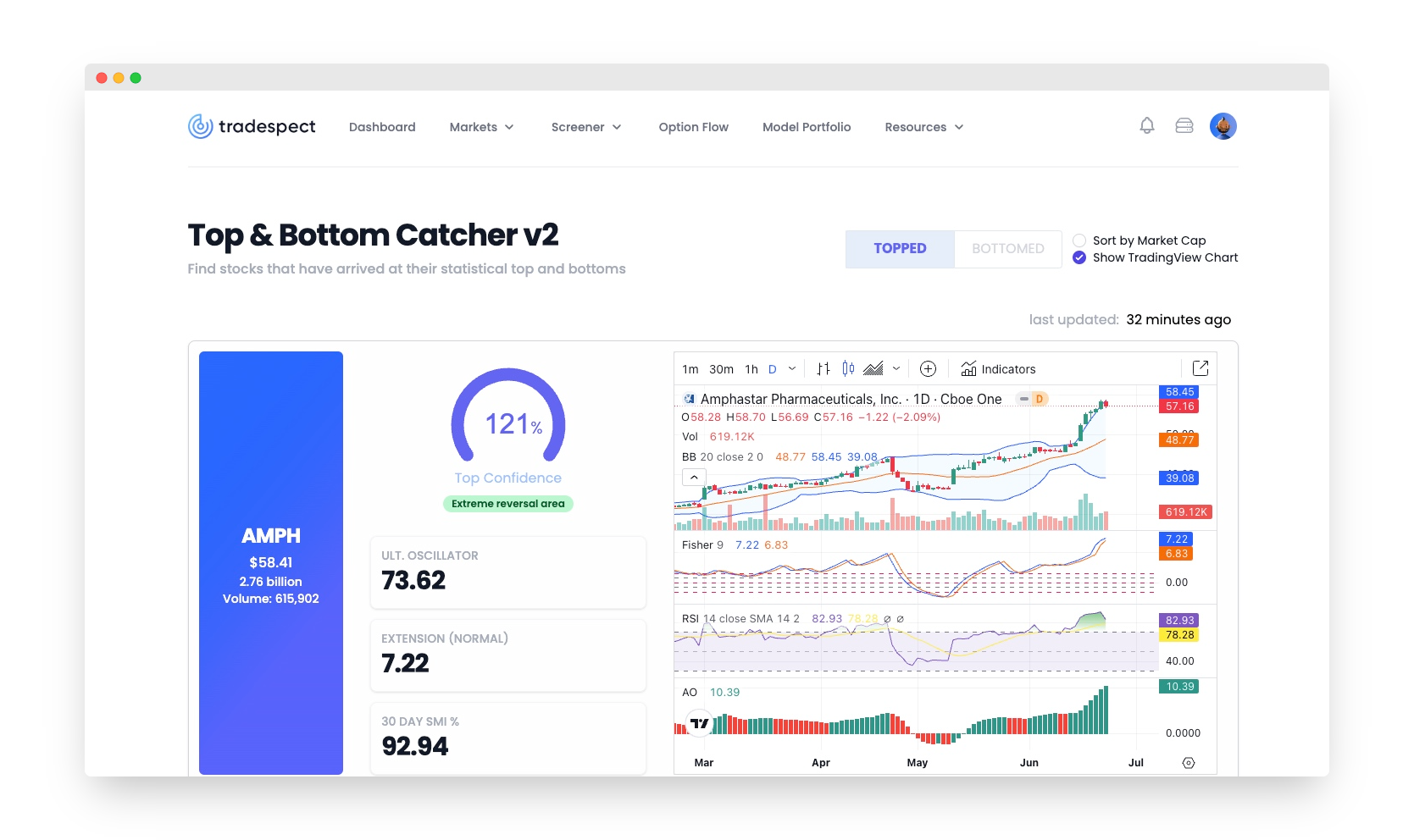

Our flagship, Top Trades Version 2, features hundreds of highly accurate and AI-confidence trade ideas valid in the U.S. markets. Monitoring over 5,000+ stocks, you receive notifications when a stock has the highest chance of moving in your favor.

Penny Pulse:

Unlock a unique tool that identifies the "tops" of penny stocks post-massive short squeezes. Seize the opportunity to short sell and profit from the downside—a lucrative and once-secretive strategy now accessible to all Pro users.

Bear’s Lair:

Explore contrarian trade ideas rooted in statistical extremes derived from a set of highly reliable indicators. Identify stocks at their peaks, execute short positions before the selling begins, and capitalize on market crashes or downside trend reversals for profit.

Bull’s Beacon:

Capture the most extreme oversold stocks as they prepare to bottom out. Profit from exceptionally low prices by buying the dip when hedge funds do; once these stocks stabilize, they reverse to the upside. Seize the opportunity to buy low and sell high.

The Best AI-Driven Trade Ideas Publicly Available

Tradespect harnesses a strategy rooted in statistical extremes, using our custom indicators to sift through thousands of stocks. We pinpoint those at the absolute extremes on either end of the spectrum. Subsequently, an AI layer assesses and rates each stock based on its potential success.

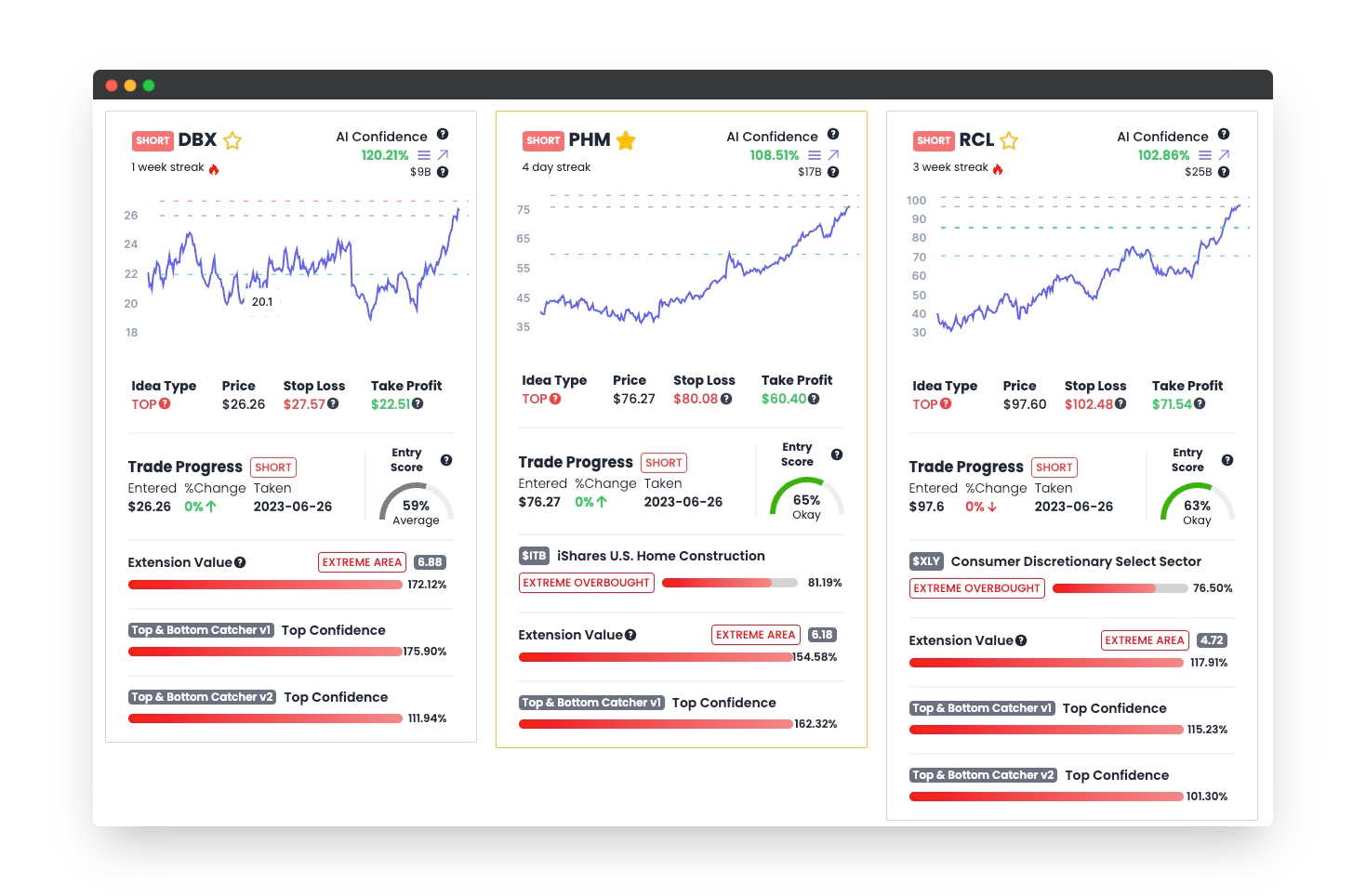

A snapshot our flagship Top Trades product:

- High-Probability Trades: Poised for reversal on the daily timeframe.

- Risk Management: AI-optimized stop loss and take profit levels.

- Trade Assurance: Real-time monitoring of entry and exit on major timeframes.

- Prime US Stocks: Focusing on highly liquid stocks with a vast market cap from Nasdaq & NYSE.

- Daily Extension Analysis: AI-rated confidence levels indicating potential tops or bottoms.

- Interactive Features: View unusual options, dark pool orders, insider trades, and more.

- Proven Success: 70% win rate on trade ideas.

- Abundant Opportunities: Hundreds of high AI-confidence trade ideas per week.

A contrarian approach that has you buying low & selling high

While many products guide you to follow existing trends, Tradespect helps you capture trend reversals as they unfold, enabling you to capitalize on the entire movement within the daily timeframe.

Understanding the Power of Contrarian Logic:

- Stocks at statistical extremes typically exhibit a strong inclination to reverse direction.

- Smart money strategies involve selling at peak highs and buying at extreme lows.

- Contrarian traders focus not on the ongoing trend, but on its impending conclusion.

- The most substantial profits arise from capturing entire trends from their peak to their trough.

- With our approach, you won't have to fret about entering a trend only to see it immediately reverse – a common pitfall with trade ideas from other platforms.

- Instead of buying into the hype, invest in oversold conditions pre-hype. Remember, market players often reap the highest rewards when selling at the height of such hype.

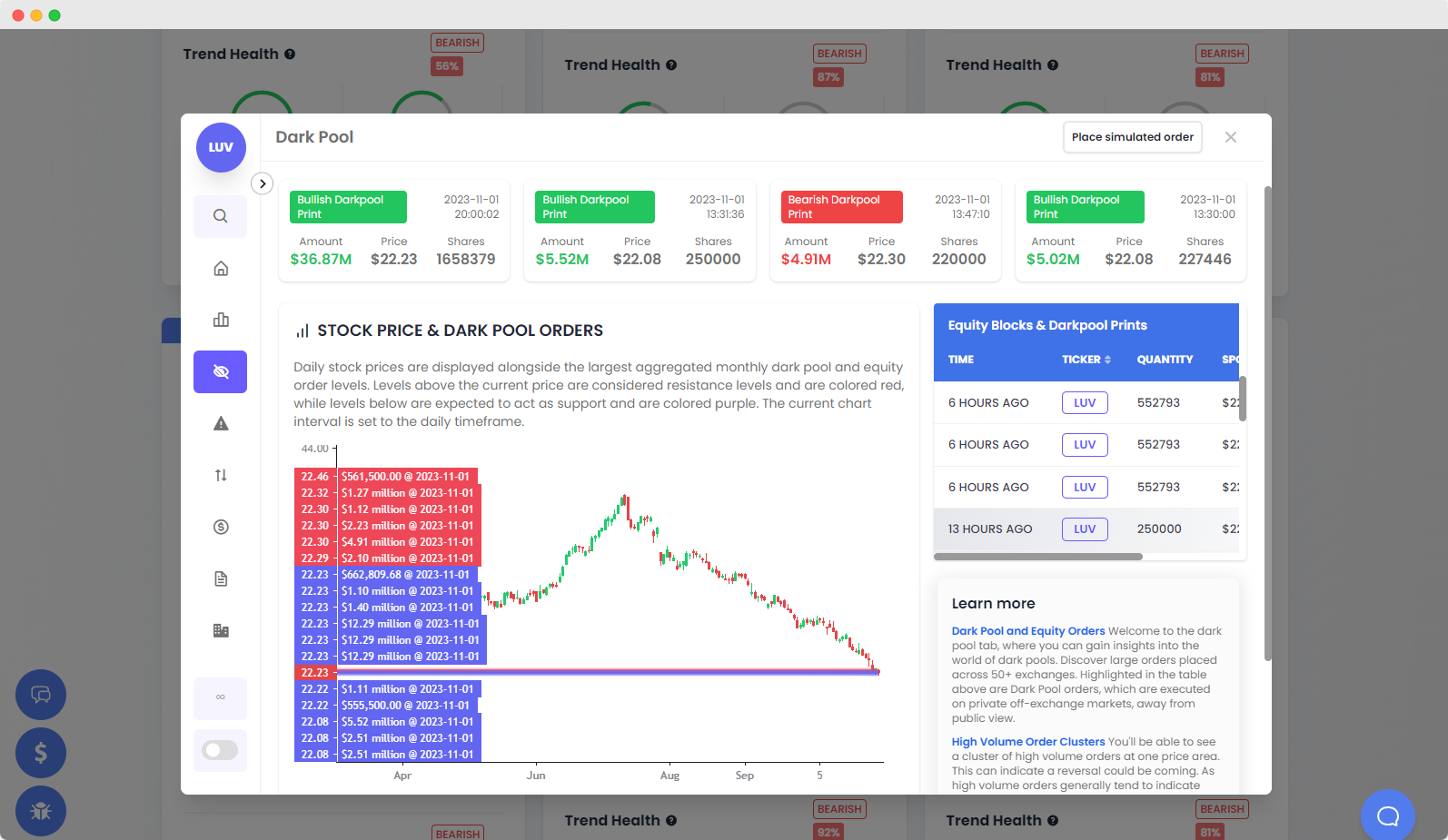

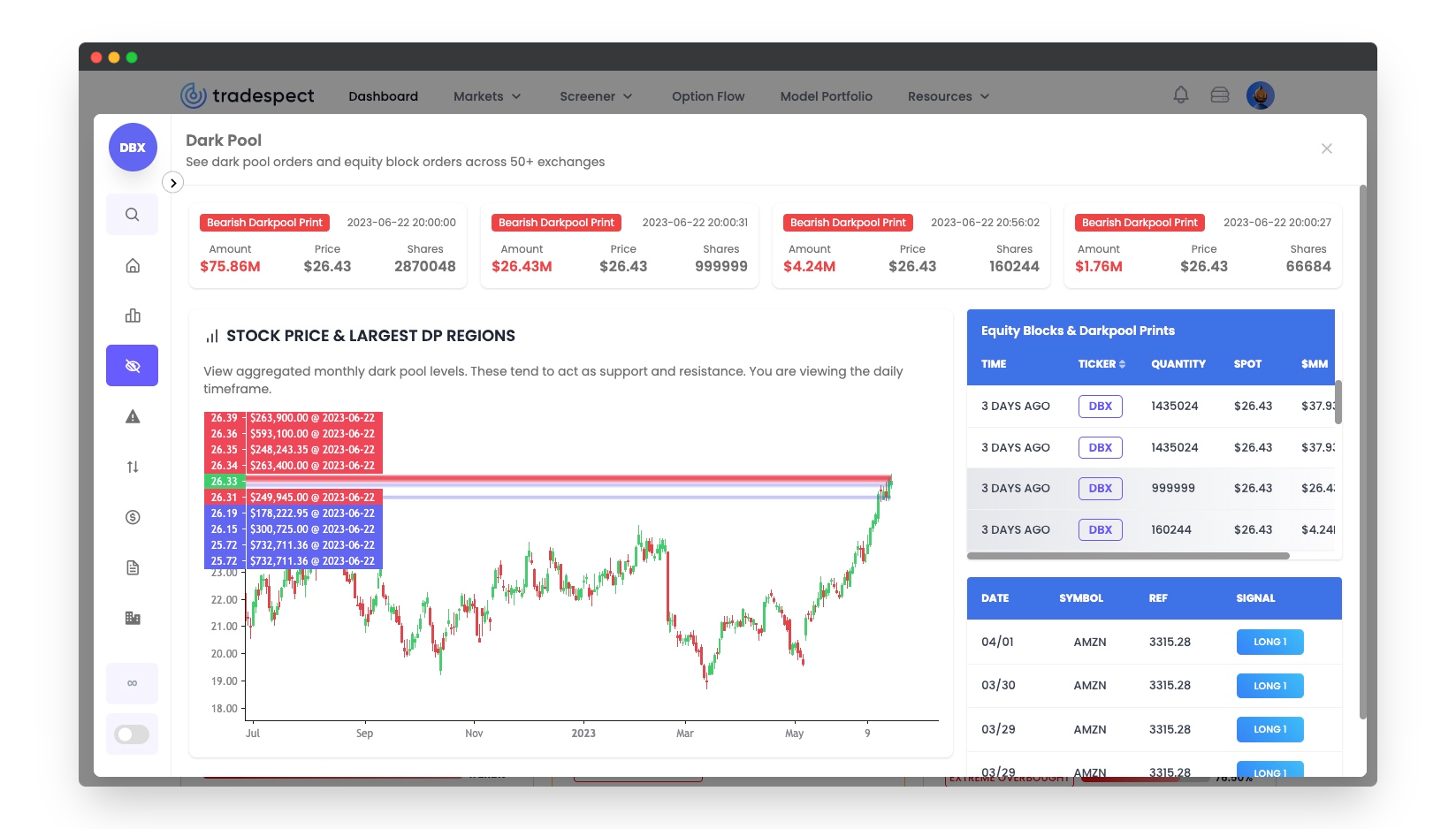

Glance at critical & hidden data on any stock

Tradespect consolidates crucial data into a single accessible pop-up, termed the "QuickGlance." Available for any ticker across the platform, this feature allows you to effortlessly view pivotal information about the stock, empowering you to make well-informed decisions based on your analysis.

An overview of QuickGlance features:

- Dark Pool and Equity Block Orders Displayed Visually

- Unusual Options Orders Highlighted

- Enhanced Charting Tools

- Visualized Graph of Insider Trades

- Convenient Cheat Sheets

- Cycle Analysis (Coming Soon)

- Two-Decade Seasonality Insights (Coming Soon)

- AI-Predicted Price Forecasts (Coming Soon)

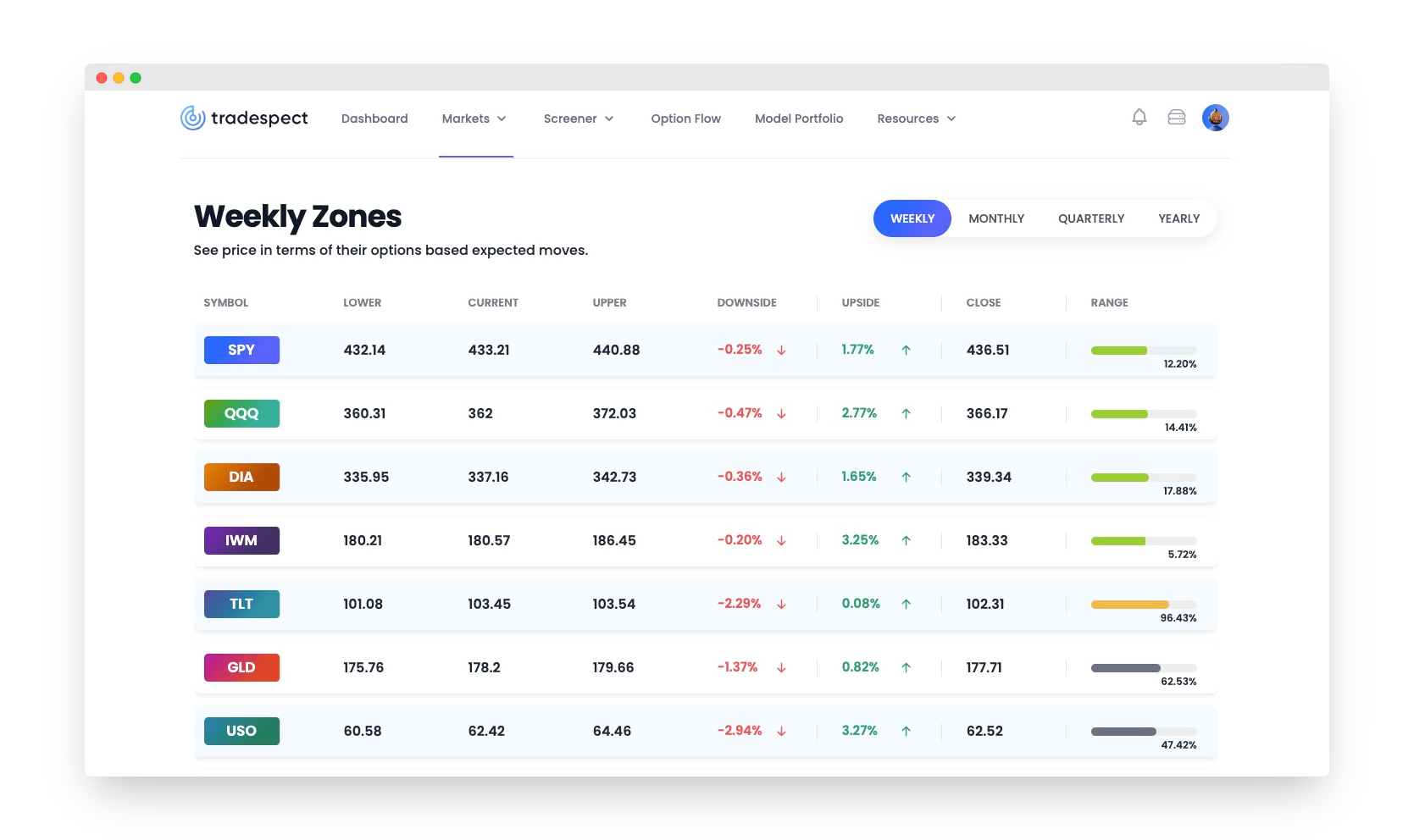

Options expected moves made visual

Observe over 20 major assets and evaluate their prices based on expected moves using the options market's implied volatility. Use the upper and lower bounds as potential support and resistance markers. Determine when a stock or asset is overvalued or undervalued based on options IV.

An overview of the Zones tool:

- Observe a progress bar, transitioning from green to red, indicating the extent to which an asset's price is overextended relative to its expected moves.

- Identify upper and lower bounds that often serve as potential support or resistance points.

- Examine these ranges for expected moves on a weekly, monthly, quarterly, and yearly basis.

- Effortlessly assess the health of major ETFs, indices, and stocks without any manual calculations.

- Consider taking a trade in the opposite direction when an asset appears significantly overpriced or underpriced, as guided by the colored progress bars.

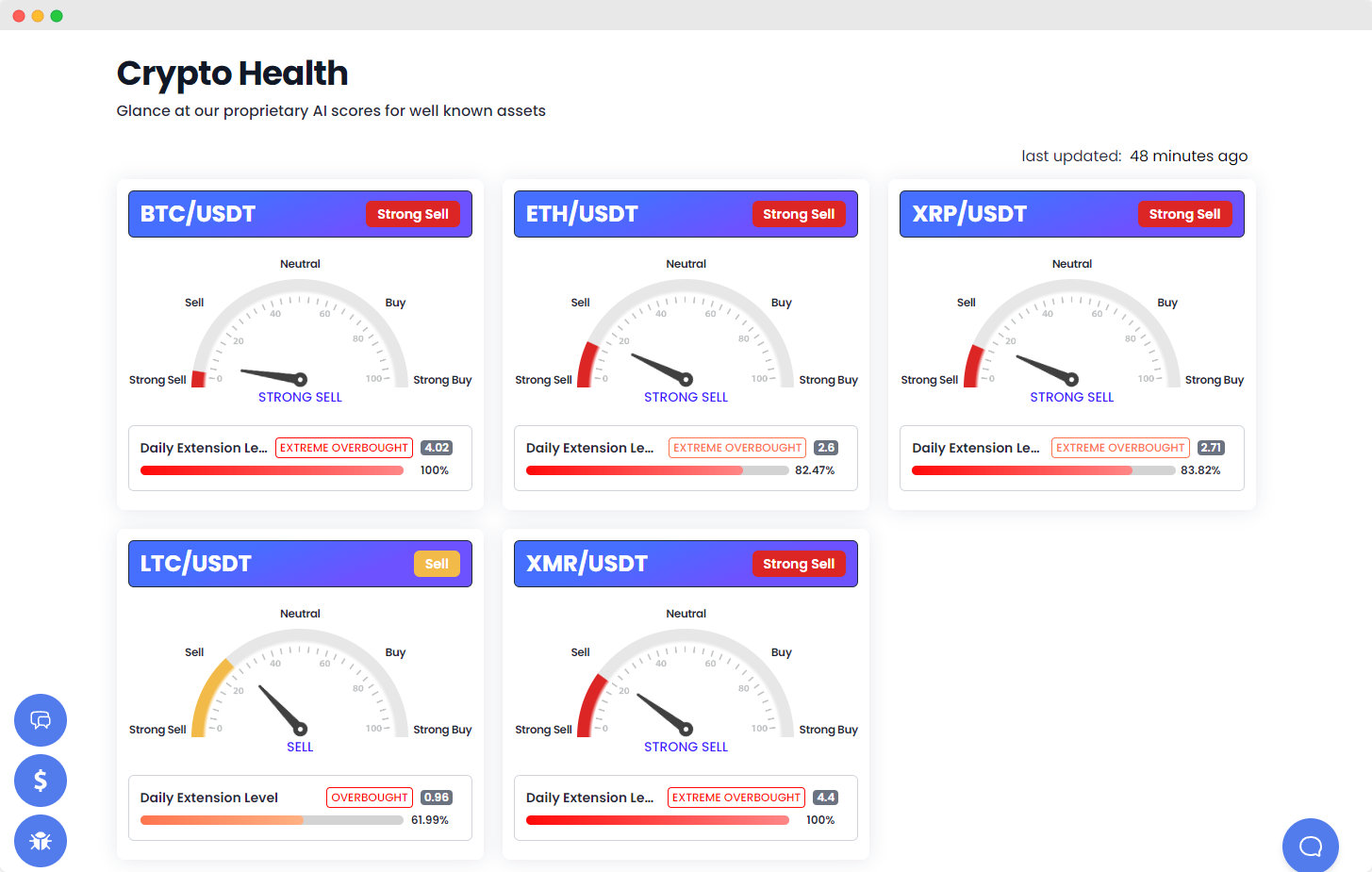

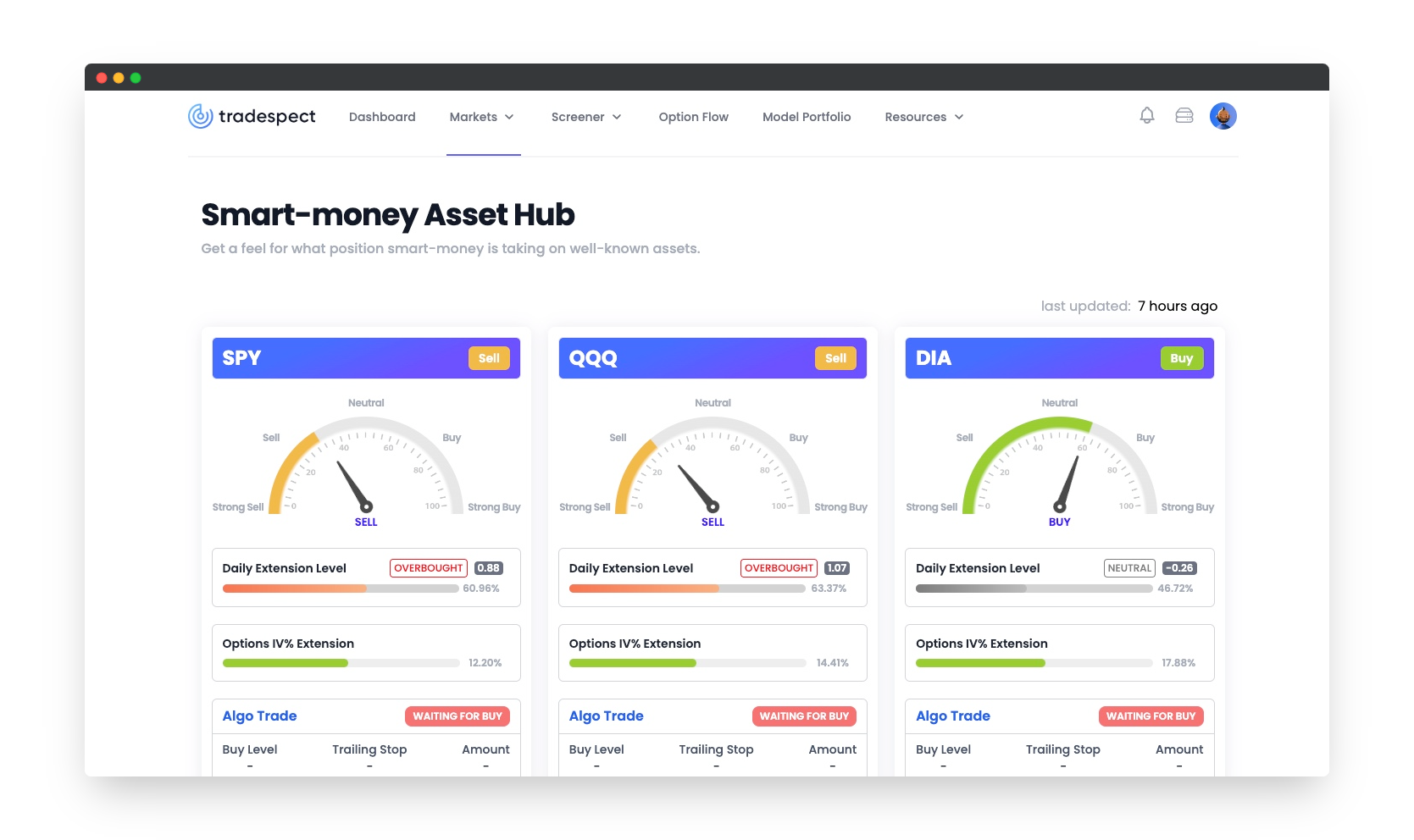

Gain insights into smart-money on major indices and crypto

We offer contrarian "smart-money" Buy or Sell gauges, grounded in a dependable suite of contrarian indicators. This insight reveals the positions "smart-money" is adopting at current price levels across various assets.

An overview of the Asset Hub and Crypto Health:

- Track the "smart-money" indicators for 5+ cryptocurrencies.

- Anticipate Algo Trade buy and sell levels (Coming Soon).

- Keep tabs on the sophisticated "smart-money" indicators for over 20 assets, including indices and ETFs such as SPY, QQQ, IWM, and others.

- These reputable indicators boast a strong track record of pinpointing market peaks and troughs, guiding you to buy at significant lows and sell at pronounced highs.

- Align with smart-money strategies: don't get caught off guard by news, events, or market panics. Recognize the data-driven opportunities to buy or sell.

What our clients say

Where the Trading Community Thrives Together. Crafted by Seasoned Traders with a Lifetime of Experience, Catering to Retail Traders of All Levels.

“Tradespect stands out as the singular tool in the market that employs contrarian logic. I had been on the hunt for a tool to pinpoint the peaks and troughs in stocks, and this is unquestionably that remarkable instrument. I've grown weary of chasing trending moves, so it's refreshing that Tradespect excels in identifying trend breaks and reversals!”

Matthew DeLuca

Alternative Investments Analyst“Tradespect not only doubled my portfolio size but also obviated the need for subscriptions to multiple analytics platforms. It's a genuine game-changer. Truly, it's the all-in-one solution I required and has become the primary tool in my trading arsenal.”

Alex M.

Swing Trader and Discord Member“Tradespect was originally created as a personal project to enhance my trading profits. However, as we continually refined it over the years, it became so effective that we felt the public should benefit from the platform's insights. Our aim is to help traders achieve the best profitability possible.”

Roxolid

Options Trader and FounderHow we stack up against the rest.

Clear, competitive pricing and a distinctive feature lineup set us apart from the rest.

Premium Plan |

||||

| High Probability AI-Driven Trade Ideas |

|

|

|

|

| Contrarian Logic (Buy Low, Sell High) |

|

|

|

|

| High Win Rates & History of Positive Returns |

|

|

|

|

| Dark Pool Data & Unusual Options Data |

|

|

|

|

| Integrated AI Trading Bot (Soon) |

|

|

|

|

| AI-Driven Crypto Analytics |

|

|

|

|

| Trade Idea Discord Bot for Servers |

|

|

|

|

| Great Support and Discord Community |

|

|

|

|

| Built to maximize your trading profits |

|

|

|

|

Plans & Pricing

The all-in-one suite designed to make you a success in the markets. At an unbeatable price.

Starter

Gain access to all core features, with hundreds of high-probability AI-generated trade ideas weekly spanning the entire U.S. market, monitoring over 10,000 stocks. Tons of apps and filters that allow you flexibility to find the best strategies.

- Full access to our Flagship Top Trades v2

- Real-time Trend Health & Reversal Levels

- AI Stop Loss/Take Profits

- Full access to the QuickGlance

- Real-time Monitor

- Full access to the Top & Bottom Catcher v1

- Visualize Insider Orders (Buy/Sells)

- Unlock 5+ AI-Driven Apps

- Penny Squeeze Finder

- AI Options Zones Tool

- Simulate our trades ($1M Balance)

Pro

We recommend to start with Pro and unlock the full power of Tradespect, designed and maximized to make you a profitable trader. Our tools are made exclusively to generate profits and prevent losses.

- Unlimited Top Trades v2 with Filtering

- Real-time Trade Monitor as you Enter

- Unlimited QuickGlance Quota

- Top & Bottom Catcher v2

- Most Recent Dark Pool Orders Visualized

- Asset & Crypto Hubs for Reversals

- Unlock the Penny Pulse & Penny Rush

- Invite for VoxMachina

- Trade alerts Discord Bot for servers

- And many more Pro features...

- Simulate any trades ($5M Balance)

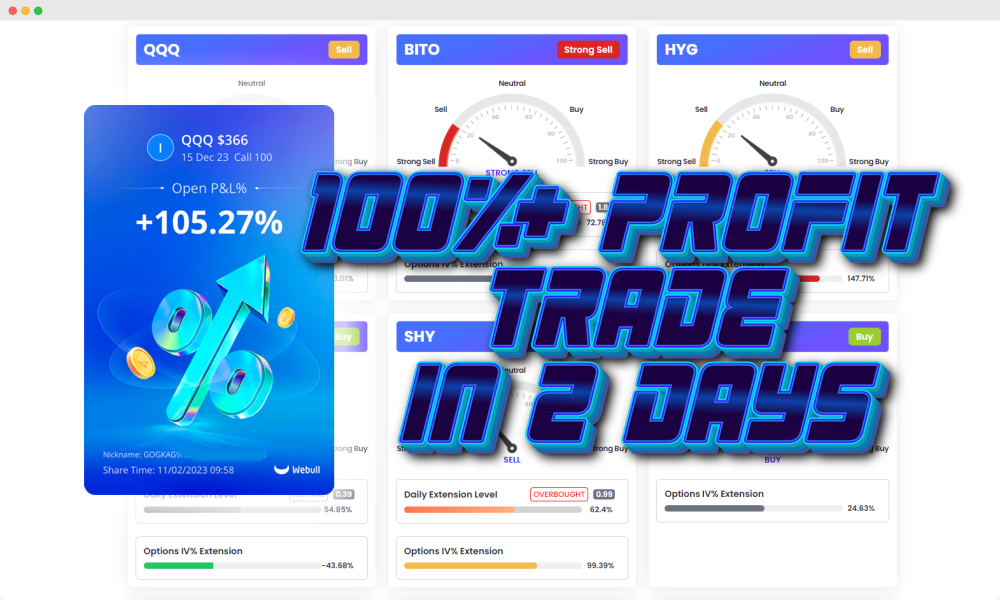

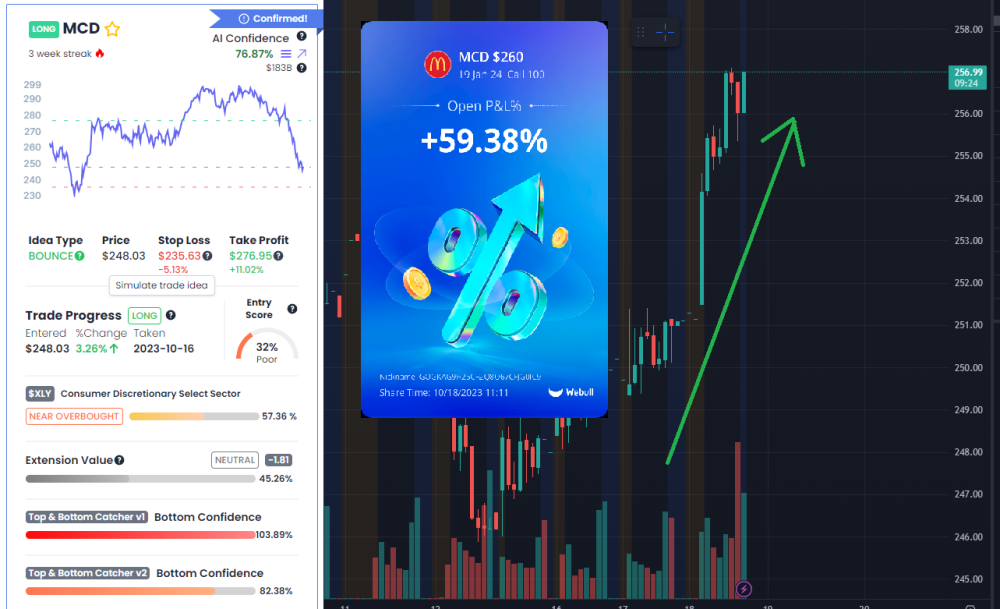

Transparent AI trades

Trade showcased for this week

See the most recent trade performance from our AI portfolio

Read from our blog

Check out some of our latest blog posts below.

Does Tradespect provide financial advice?

Tradespect is a data-driven platform and does not provide financial advice. We generate trade ideas algorithmically based on various indicators and provide users with valuable market data. While we offer stop loss levels to limit downside risk, the ultimate decision and responsibility for executing trades lies with the user. You can further investigate any stock on our platform by accessing its data, such as unusual options flow, dark pool data, insider trading orders, and more.

What does Tradespect do?

Tradespect monitors over a thousand stocks in the US markets, focusing on high liquidity and large market cap stocks. We analyze various variables, including price movements, using a normal Gaussian distribution over a 12-day period. This allows us to identify tops and bottoms by measuring price deviations beyond a standard deviation of 2 or more. We specialize in contrarian indicators and our trading approach revolves around shorting tops and longing bottoms. Tradespect does not follow trending moves.

Why does Tradespect focus on reversals?

At Tradespect, we believe that swing trading on the daily timeframe is where you can potentially make the most profit. By focusing on reversals, we aim to capture the full trending move of a stock until its next reversal occurs. Daily trend reversals typically last more than 10 days, and trading on this timeframe reduces noise and allows for better position management. It offers traders the opportunity to hold positions for one week to three months without constant monitoring.

What other data does Tradespect provide on a stock?

Tradespect strives to provide comprehensive information when presenting a stock idea. In addition to trade ideas, we offer data on dark pool orders, equity block orders, insider orders, unusual options orders, seasonality, dominant cycles, and more. We do not rely on fundamental data as we prioritize price action in our analysis.

Do you offer Discord Bots?

Yes, we offer a Discord bot for Pro users. The bot allows you to add our alert bot to your Discord community, enabling users to receive the latest trade ideas from our Top and Bottom catchers. However, it is essential for users to conduct their own analysis and make informed decisions before executing trades. The Discord bot serves as a convenient tool to stay updated with trade ideas from Tradespect.

Is Tradespect suitable for beginner traders?

Tradespect can be used by traders of various experience levels, including beginners. Our platform provides educational resources and trade ideas to assist traders in their decision-making process. However, it is important for beginners to thoroughly understand the risks involved in trading and to start with smaller position sizes while gradually gaining experience.

Can Tradespect be used for day trading?

While Tradespect focuses more on swing trading and capturing longer-term trends, it can still be utilized by day traders. The platform provides valuable data and trade ideas that can be adapted to shorter timeframes. Day traders can utilize the information provided by Tradespect to identify potential intraday reversals or to supplement their own trading strategies.

How accurate are the trade ideas generated by Tradespect?

The accuracy of trade ideas generated by Tradespect cannot be guaranteed, although we provide a score called “AI Confidence” which can give you an idea of potential accuracy of the trade idea. The market is inherently unpredictable, and trading involves risks. While Tradespect utilizes statistical extremes and contrarian indicators to identify potential reversals, it is essential for users to exercise their own judgment, conduct further analysis, and consider risk management strategies before executing trades.

Can Tradespect be used for options trading?

Yes, Tradespect can be used for options trading. The platform provides data on unusual options orders, which can be valuable information for options traders. However, it is important for options traders to have a solid understanding of options trading strategies and associated risks before incorporating Tradespect's data into their decision-making process.

Does Tradespect provide real-time data?

Tradespect provides near-real-time data. However, please note that there may be a slight delay in the data displayed on the platform. It is always recommended to verify the current market conditions and prices through your preferred trading platform or data provider before making trading decisions.

Can Tradespect be used for trading stocks outside the US markets?

Currently, Tradespect focuses on monitoring stocks in the US markets. The platform primarily analyzes stocks with high liquidity and large market capitalization listed in US exchanges. While the concepts and indicators used by Tradespect may apply to other markets, the data and trade ideas generated are primarily tailored to the US stock market.

Does Tradespect offer a free trial?

Yes, Tradespect offers a free trial for users to explore and experience the platform's features. The free trial period allows users to access a limited set of trade ideas and data. For more comprehensive access to trade ideas and additional features, there is a Pro subscription available for a fee.

How can I contact Tradespect's customer support?

For any inquiries or assistance, you can reach Tradespect's customer support team by using the chat icon on the lower right of your screen. Our dedicated support team will be happy to help you with any questions or concerns you may have regarding the platform or its features.