Tradespect vs. Tradytics: Unveiling the Superior Trading App for Maximized Profits Written on . Posted in Tradespect Blogs.

Tradespect vs. Tradytics: The New Age of Trade Analysis

In the competitive world of trading apps, it's paramount to discern between platforms that genuinely provide an edge and those that offer the illusion of one. In this post, we take an in-depth look at two such apps - Tradespect and Tradytics - to ascertain which one truly leads the pack.

1. Philosophy Behind the Trade Ideas:

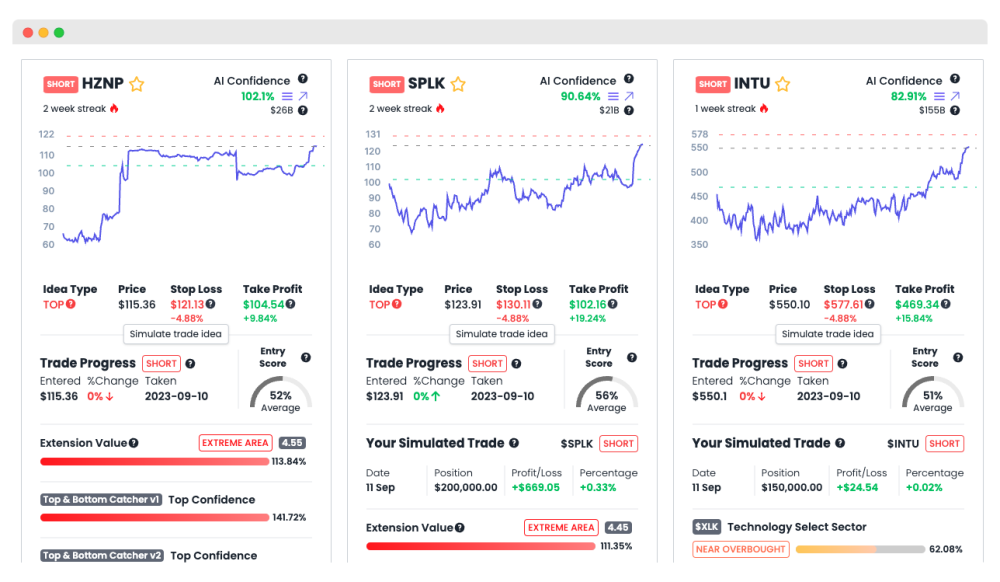

- Tradespect: Contrarian Wisdom Tradespect adopts the contrarian approach. This strategy believes that the majority of market participants are often wrong, making it profitable to take positions against the prevailing trend. By capitalizing on overreactions, Tradespect provides high probability, high profit, and low-risk trade ideas. This approach has historically proved to be effective, especially during times of market volatility.

- Tradytics: Trend Followers In contrast, Tradytics advocates for trend-following strategies. While there's merit to this method, it often becomes counterproductive when the market is overextended, and trend reversals are imminent. Following the crowd isn't always the right choice, and history has shown us that herd mentality can lead to suboptimal outcomes.

2. Performance Metrics:

- Tradespect: With its contrarian stance, Tradespect users have reported more frequent high-profit trades, showcasing the strength of its algorithms. By tapping into human behavioral biases, Tradespect often identifies opportunities that many may overlook.

- Tradytics: While Tradytics might occasionally hit the mark, users have noted a higher incidence of failed trades. This could be attributed to its strategy of riding the trend, which may not always account for market nuances and reversals.

3. Risk Management:

- Tradespect: One of Tradespect's shining features is its emphasis on low-risk strategies. By identifying and exploiting mispriced assets, Tradespect ensures that traders aren't exposing themselves to undue risk. It's not just about making profits; it's about safeguarding your capital.

- Tradytics: With its trend-following approach, Tradytics inherently exposes its users to higher risk, especially during sudden trend reversals. This can be problematic for traders, especially those without a robust risk management strategy in place.

Conclusion:

In the ever-evolving realm of trading, it's crucial to align oneself with tools that provide a genuine edge. While Tradytics' trend-following approach has its place, its effectiveness pales in comparison to the contrarian strategies championed by Tradespect. By capitalizing on the inherent biases and overreactions present in the market, Tradespect emerges as the superior choice for traders seeking high probability, high profit, and low-risk trade ideas.

Remember, in trading, it's not about following the crowd; it's about identifying opportunities that the crowd misses. And that's where Tradespect shines.

Disclaimer: The information provided in this post is for educational purposes only. Always conduct your research and consult with a financial advisor before making any investment decisions.