Discovering Opportunity in the Shadows: The Penny Stock Catcher for Shorting Overextended Stocks Written on . Posted in Tradespect Blogs.

The world of penny stocks is as enigmatic as it is volatile. These low-priced shares, often trading under $5, can offer high rewards, but they're not without risk. For those who understand the mechanics of the stock market, however, these risks can become opportunities.

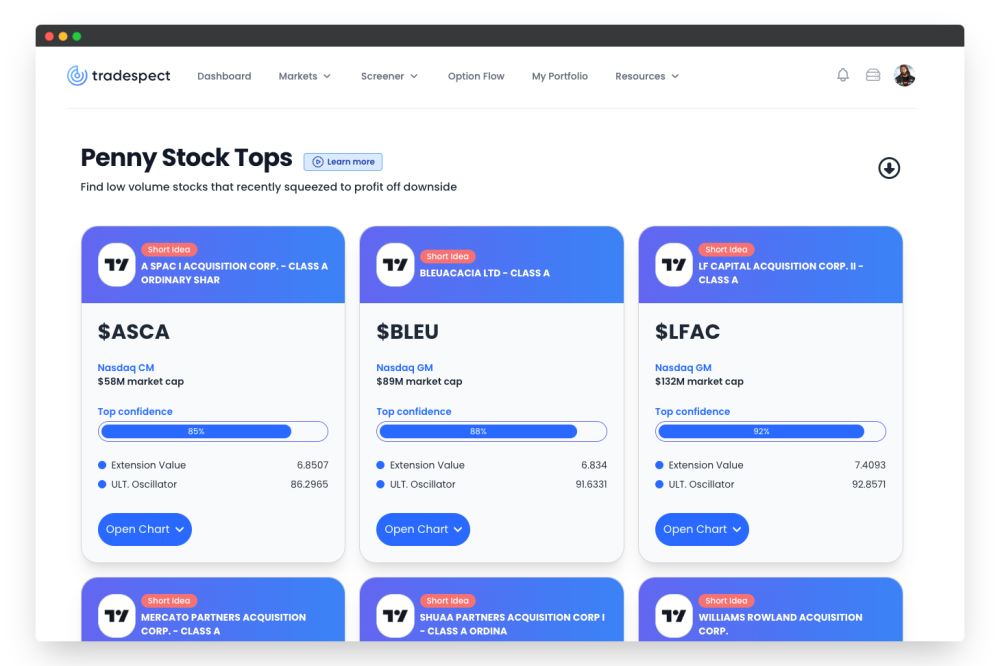

Enter our new tool: The Penny Stock Catcher. This innovative tool is engineered to detect penny stocks that have squeezed and overextended to the upside. For traders who revel in the thrill of short selling, this can be an indispensable asset.

1. The Science Behind the Squeeze:

A stock squeeze typically occurs when there's a significant shortage of stock supply but a high demand, driving the prices up. Many times, this scenario is coupled with low volume and low market cap, making the stock's movement all the more volatile. When the squeeze ends, there's usually a drastic price drop.

2. Overextension – A Warning Sign:

Overextension is when a stock's price has moved significantly away from its average, usually indicating it's ripe for a reversal. By combining squeeze detection with overextension analysis, the Penny Stock Catcher can pinpoint stocks poised for a potential drop.

3. Shorting the Top – The Profit Potential:

Armed with the insights from our tool, traders can then short these stocks. Shorting, or selling shares you don't own with the intention of buying them back at a lower price, is a strategy used to profit from falling stock prices. When overextended stocks start to plummet, short-sellers stand to gain.

4. Why Penny Stocks?

Penny stocks, due to their low market cap and low volume, can move drastically on relatively small news or even market sentiment. This can lead to rapid overextensions and, subsequently, significant downsides. The volatility of penny stocks, while daunting to some, is a treasure trove for informed traders.

5. The Penny Stock Catcher in Action:

Our tool uses a combination of algorithms that factor in volume, market cap, price movement, and other proprietary indicators. The aim? To present traders with a concise list of stocks that have surged due to a squeeze but might be on the verge of a fall.

Conclusion:

In the volatile sea of the stock market, our Penny Stock Catcher can act as a beacon for those looking to navigate the tumultuous waters of penny stocks. It doesn't promise a foolproof route to riches—no tool can. But, with a deep understanding of market mechanics and a tool designed to shine a light on overextended penny stocks, traders have a unique opportunity to potentially profit from the market's ebbs and flows.

Disclaimer: Trading in penny stocks and short selling carries a high level of risk. Always conduct thorough research and consider seeking advice from financial professionals before making any investment decisions.

Our tool uses a combination of algorithms that factor in volume, market cap, price movement, and other proprietary indicators. The aim? To present traders with a concise list of stocks that have surged due to a squeeze but might be on the verge of a fall.